Analyst Wilson Withiam of the top-tier blockchain analytics firm Messari has unveiled the peculiarities of recent listing campaigns that took place on the U.S. exchanges. He also shared some observations on who may best benefit from it.

2020 Listing Pumps Still Have Enough Strength to Boost Triple-Digits

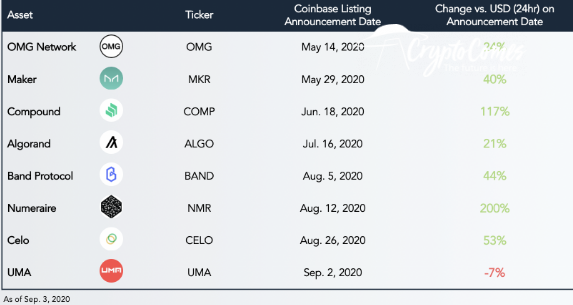

In his recent report An Inside Look at U.S. Crypto Exchanges Listings Mr. Withiam shared the statistics of the most recent listings on Coinbase, the leading U.S. cryptocurrencies exchange ecosystem. All of the Summer 2020 additions to the assets suite Coinbase resulted in impressive price spikes.

NMR, a native asset of the digital currencies hedge fund Numeraire and COMP (governance utility token of Compound Finance DeFi protocol), showcased the most striking gains. NMR tripled in 24 hours, while COMP more than doubled.

The UMA coin appears as the only extinction in this row, but its listing coincided with the exhausting bloodbath across the entire crypto market. Mr. Withiam also admitted that it was the sunset of UMA splendid rally:

Onlookers should also note that UMA was up 230% in the week leading up to its announcement, which may have been a byproduct of its coincidental involvement in SushiSwap

Though very predictable and ingenious, Coinbase listing pumps remain powerful catalysts of short-term price rallies for all sorts of coins.

Cui bono?

Mr. Withiam attempted to indicate real beneficiaries of listing campaigns. He stressed that this year is the obvious champion in terms of new assets being added for all of the leading U.S. exchanges, mostly Gemini, Coinbase, Kraken, and Binance US.

This not only applies to traders, but also the exchanges themselves that may benefit from the overhyped listings. According to the report, four of the six last Coinbase asset listings are in the Coinbase Ventures portfolio.

So, all of the Coinbase Ventures portfolio assets may be highly subject to listing pumps. Some of them are close to mainnet release, e.g. Near Protocol (NEAR), Coda Protocol (CODA), Spacemesh (SMC), The Graph and BioXRoute.

Mr. Withiam concluded that U.S. exchanges are missing great opportunities for instant listings of DeFi governance tokens.