Software entrepreneur, founder of leading Megaupload file storage and prominent privacy activist Kim Dotcom shared his views on the present performance of his two favorite assets, one traditional and one digital.

"A lot of money"

In his recent tweet, Mr. Dotcom asked who among his followers had bought Bitcoin (BTC) and Gold (XAU). He stressed that the performance of both assets allowed their holders to make "a lot of money."

Did you buy Bitcoin and Gold like I said? Congratulations, you have made a lot of money.

— Kim Dotcom (@KimDotcom) August 17, 2020

Mr. Dotcom ruthlessly slammed the opinion of his followers regarding the uselessness of Bitcoin (BTC) and gold. However, numerous commentators attempted to promote their favorite assets to him.

It is no surprise that Chainlink (LINK), supported by an aggressive community of LINK Marines, was mentioned frequently. Ethereum (ETH) fans highlighted that after Black Thursday, Ether significantly outperformed Bitcoin (BTC) and continues to surge faster than the flagship cryptocurrency.

Also, the discussion was not without Amazon (AMZN) stock promoters and poisoned skeptics who called the entire cryptocurrencies trading industry a scam.

Bitcoin & gold or Bitcoin vs. gold?

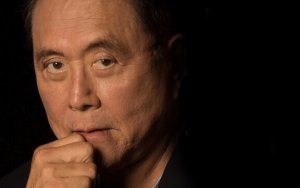

That tweet by Mr. Dotcom proves that he belongs to the camp of investors that treat Bitcoin (BTC) and gold equally as natural and reliable investments. For instance, a similar opinion was repeatedly shared by famous coach, writer and speaker Robert Kiyosaki.

The "Rich Dad, Poor Dad" author outlines that Bitcoin (BTC), gold and silver are the best "save haven" assets during the tough days of financial recession.

Instead, a smaller group of investors, e.g., prominent "Gold Bug" Peter Schiff, is sure that Bitcoin (BTC) is far worse than gold in terms of investment attractiveness due to its lack of utility and intrinsic value.