Decentralized exchange liquidity provider Bancor has launched version 2 of its protocol.

A new automated market maker (AMM) liquidity pool integrated with Chainlink oracles is already live.

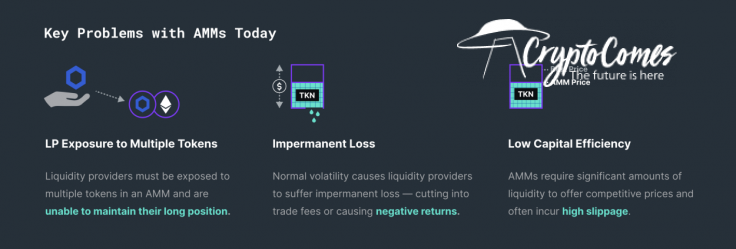

As part of the update, Bancor also introduced 20-fold liquidity amplification to significantly reduce slippage.

The Chainlink fix

Chainlink’s oracles, which provide on-chain price feeds, have been adopted by multiple DeFi projects, including Synthetix, Kyber Network, Orchid, Bancor and others. They are shaping up to be the blueprint for the entire industry.

Back in June, the BNT/USD Chainlink price feed went live on the Ethereum mainnet.

Chainlink provides Bancor’s DEX with high-quality data, helping to balance the level of liquidity between different cryptocurrencies and prevent arbitrage opportunities.

By keeping the value of Bancor’s liquidity reserves at the same level, it becomes possible to ensure the mitigation of impermanent losses even when volatile cryptocurrencies are involved.

The novel design of the LINK/BNT pool allows liquidity providers to maintain single-token exposure, thus solving another key problem of AMMs.

Temporary limitations

The upgrade is currently in a beta-testing phase, and pools have liquidity caps of up to $1 mln.

“Once a pool’s liquidity cap is reached, no more liquidity providers can join the pool until the cap is removed. After the cap is removed by a pool manager, it can never be reactivated in the given pool.”

According to Bancor’s head of product Nate Hindman, they are currently working on solutions that could allow smaller tokens with no oracle to utilize the V2 pool.

“Currently, it is limited to tokens that do have an external market to Bancor or, you know, somewhat sufficient liquidity.”