The cryptocurrency market again develops lateral movement in most assets. Its capitalization continues to consolidate from the end of May in the range of $250 to $285 bln. The first cryptocurrency updated the annual maximum, rising above the mark of $9,300. The top altcoins also followed its example.

Over the previous week, Bitcoin has grown by almost 20% and the total market capitalization has risen by 17%. Litecoin demonstrated the best price dynamics for 7 days, growing steadily in anticipation of the upcoming halving.

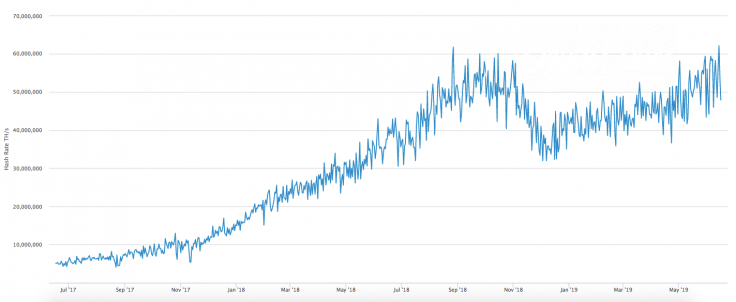

What is more, the Bitcoin network hashrate updated the historical maximum at 62.24 EH/s, following the price rise.

However, the current levels might not be the peaks, as Tether again released $100 mln USDT. Respectively, it might be the sign of a future market pump, as it happened before.

BTC/USD

Bitcoin broke the $9,195 mark according to our recent scenario, and reaching $10,000 is just a matter of time.

On the weekly chart, one can see that overcoming the mark of $9,300 canceled a bearish reversal, the prospect of which became more likely after the formation of the Doji candle. Thus, the nearest resistance level at $9,442 (38.2% Fibonacci level) can be shortly achieved.

At the same time, a short-term pullback to $8,000 is possible, since the price and trading volumes formed a bearish divergence, and the RSI indicator is in the overbought zone, above 70.

The price of BTC is trading at $9,203 at the time of writing.

ETH/USD

Our Ethereum price prediction made earlier justified itself, as the $270 mark was reached before June 20. Besides the general market rise, the price of the leading altcoin might have been caused due to the announcement by the platform developers to launch the Ethereum 2.0 phase in January 2020. The update is primarily noteworthy by activating Proof of Stake.

On the hourly chart, Ethereum is looking rather bearish than bullish, which is confirmed by the technical indicators. Mainly, the MACD lines are looking downwards, suggesting the possible rollback in the short-term scenario. RSI is also located near its bottom levels, which means that sellers have not given up their positions yet. In this regard, a slight correction to $264 can happen in a few days.

The price of ETH is trading at $256.10 at the time of writing.

XRP/USD

Against the background of the market growth over the weekend, Ripple rose the most compared to other top coins. The quotes of XRP are going up even now when most of the assets are facing a correction.

Ripple keeps showing positive price dynamics; however, that cannot last forever. On the hourly graph, the coin is trading near its local maxima, and a rollback is a matter of time as a short-term idea. In this regard, there is a high possibility of a decline to $0.42, which serves as a close support zone.

The price of XRP is trading at $0.4280 at the time of writing.