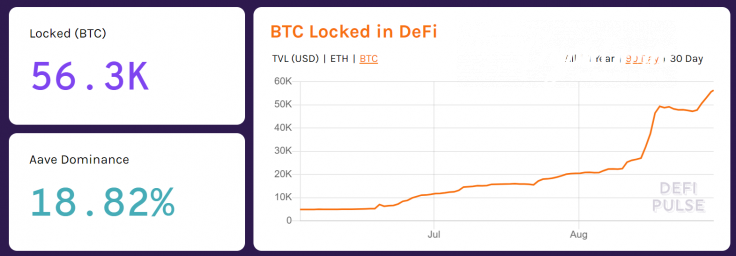

According to data from Defipulse.com, more than 56,000 BTC is now locked in Decentralized Finance (DeFi) protocols on Ethereum. That is equivalent to $644 million, up from $57 million in June, within just two months.

Bitcoin users have been moving BTC over to Ethereum-based DeFi, often in the form of Wrapped Bitcoin (wBTC). By using wBTC on DeFi protocols, users often get exposure to yield. As Rob Paone explains:

“wBTC means access to yield. Lightning means transactions/commerce. I think the below tweet from Lark might say more about the use case than the technology itself People care more about yield on Bitcoin than buying things with Bitcoin (presently)”

Explosive Growth of DeFi on Ethereum Showcased Again

While there are certain risks involved in using wBTC to earn yield, such as smart contract risks, the yield has attracted Bitcoin users to the DeFi market.

The amount of BTC on DeFi protocols is now comparable to the reserves of major exchanges, Markets analyst Zack Voell wrote. 51,156 BTC is equivalent to almost half of the reserves of Gemini, Bittrex, and Bitstamp, three major Bitcoin exchanges across the U.S. and Europe. He noted:

“51,156 bitcoins are now tokenized on Ethereum. That's 4% more bitcoin than Poloniex is holding, nearly 50% of Bittrex, 53% of Gemini, and 44% of Bitstamp. Pretty impressive TBH.”

The increasing number of Bitcoin on Ethereum follows the overall growth of the DeFi space. Since July 1, in less than two months, the total value locked in DeFi rose from $2 billion to over $8.6 billion.

Referring to the fast expansion of the DeFi market, ConsenSys member John Lilic said:

“The total number of BTC is not the impressive part. It’s the wicked rate at which the number is growing.”

DeFi Still Not Big Enough For “Huge Traders”

For now, DeFi might be too niche for whales or large individual investors. When asked about DeFi support, Bitfinex chief technical officer Paolo Ardoino said the exchange has “huge traders,” suggesting that hedging products take priority. He stated:

“No DeFi related for the moment. Already too much of that out there. Finex has huge traders with quite big positions. They need few important hedging products. If you guess my marketing will kill me to spoiler stuff in advance.”

Ever since the initial introduction of the DeFi perpetual futures index contract by FTX, major exchanges followed suit.