Skew analysts unveiled the statistics of net open interest registered on Bitcoin (BTC) and Ethereum (ETH) futures markets. Despite a recent painful correction, some indicators on this market showcase an impressive upsurge in 2020.

Ethereum (ETH) contracts OI is on fire

According to statistics shared by Skew, the industry-level on-chain data vendor, in its recent tweet, Ethereum (ETH) futures markets' aggregated interest is up more than 200% despite the recent collapse.

Ether futures total open interest is looking up 3x since start of the year despite the weekend's sell-off pic.twitter.com/s7lGwqxI5s

— skew (@skewdotcom) September 7, 2020

In January of this year, aggregated open interest in Ethereum (ETH) futures markets stayed below $350 mln, or down 30% from the highs of Q4, 2019. During Crypto's Black Thursday (March 13, 2020), it had dropped to $300 mln, but then it started to gain steam.

This metric increased more than five times in five months to reach an all-time high above the unbelievable $1.7 bln mark in August. During the same period, the Ethereum (ETH) price gained 440%.

However, the ongoing sensitive correction of the cryptocurrencies market has resulted in a 47% drop in Ethereum (ETH) futures open interest. In the first days of September, it returned to sub-$1 bln territory.

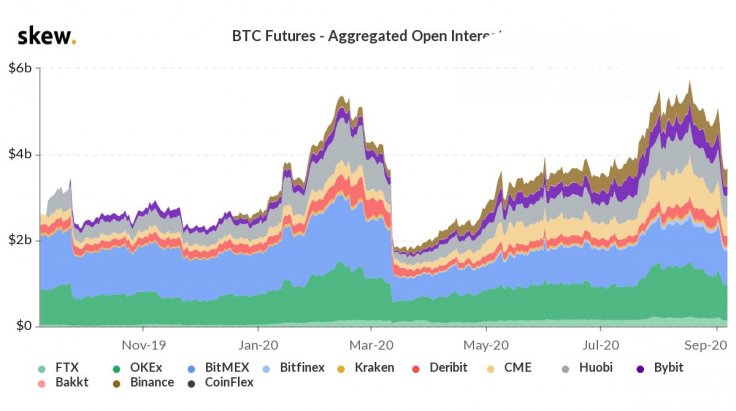

Bitcoin (BTC) futures OI is "slightly up"

Huobi Futures, OKEx and BitMEX are three dominant services on the Ethereum (ETH) contracts trading segment. Binance Futures managed to increase their share significantly.

Bitcoin (BTC) futures markets reveal far less impressive dynamics. In January, its open interest was estimated by Skew experts at $2.5 bln. Bloody March brought it below the $2 bln level, while a brilliant August rally allowed its OI to reach the $5.5 bln level. The ongoing collapse brought Bitcoin (BTC) futures OI to a 35% correction, and now it sits at $3.5 bln.

As covered by CryptoComes previously, a double-digit retrace of Bitcoin (BTC) and Ethereum (ETH) has coincided with massive miner-driven sell-offs.