ConsenSys researchers described hypothetical attacks on Ethereum (ETH) 2.0 tokenomics and proposed possible solutions to improve its security and decentralization.

More complex system, more sophisticated attacks

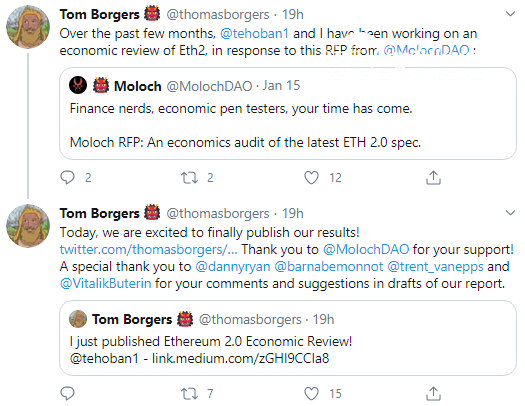

Analysts organized their research within the framework of a grant by MolochDAO for an economic review of Ethereum (ETH) 2.0. They thoroughly studied multiple possible scenarios of Ethereum (ETH) staking and indicated its possible weak spots.

First of all, the researchers confirmed that Ethereum (ETH) 2.0's design is much more complicated than that of ETH1, with its proof-of-work consensus. The security of ETH2's well-elaborated design is based on three crucial inputs: Ethereum's (ETH) price, the number of Ethers staked and price volatility. These three inputs depend on each other.

Possible attacks on Ethereum (ETH) 2.0 can be much more scalable than malevolent attempts to corrupt existing Ethereum (ETH) blockchain. They would require significantly fewer resources, e.g., hardware capacities and power consumption.

The sufficient share of Ethereum (ETH) staked is about 13.8 percent of all Ethers. This magnificent number would be reached through "capital validators," not Ethereum (ETH) enthusiasts.

When the security budget matters

Researchers revealed that the Ethereum (ETH) 2.0 network will spend less on security than ETH1 does. There will be a lack of liquidity during the ETH1-ETH2 transition.

Experts highlight that the lion's share of the liquidity that is needed badly for this transition will be concentrated in exchanges and trading platforms. Thus, the efforts of validators to leverage this share of Ethers may damage network decentralization.

ConsenSys analysts Tom Borgers and Tanner Hoban shared some recommendations on how to improve the existing situation. They suggest that users beware of "derivatives attacks," i.e., DeFi "flash loan" hacks and front-runs. Moreover, Ethereum (ETH) 2.0 devs should reconsider the reward mechanism.

An emergency scenario (i.e., Ether price collapse) should be added to this mechanism. The rewards payout instruments should alter Base Reward tools to mitigate the effects of such unintended events.