Cryptocurrency exchange Binance is attempting to capitalize on the growing enthusiasm around decentralized finance by announcing the launch of the DeFi/USDT Composite Index that will go live on Aug. 28 on its futures platform.

The underlying asset of the DEFI Composite Index perpetual contract consists of a basket of decentralized finance (DeFi) protocol tokens listed on Binance. The index price is calculated using weighted averages of real time prices of the tokens on Binance. The DEFI Composite Index is denominated in USDT.

The futures contract consists of the Top 10 biggest DeFi protocols, including Chainlink (LINK), Aave (LEND), Maker (MKR), Compound (COMP) and others.

Swipe (SXP), the native token of Binance-owned payment protocol Swipe Network, also made the cut ahead of the rollout of the SwipeFi app on Binance Chain.

Navigating the DeFi boom with 50x leverage

Binance users will be able to long or short the hodgepodge of various DeFi tokens with up to 50x leverage.

In layman's terms, this means that traders can borrow 50 times more money for their position, but the probability of liquidation increases with leverage.

The latest move shows that Binance is not shying away from the mushrooming industry niche despite CEO Chanpeng Zhao's claim that only a few DeFi projects would succeed.

As reported by CryptoComes, Binance also launched a perpetual contract for Chainlink a week ago.

The DeFi ecosystem in numbers

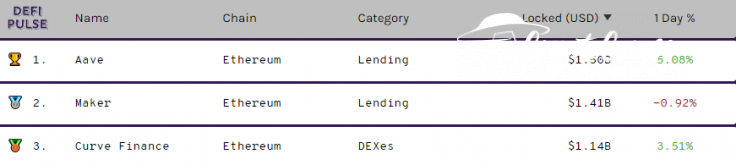

The value of the whole ecosystem has now surpassed $7 bln, according to DeFi Pulse data. Aave, Maker and Curve Finance alone account for 57.85 percent of the locked capital.

In other news, Aave's LEND token recently became the first DeFi asset to reach $1 bln market capitalization, according to Messari's Ryan Watkins.

The token skyrocketed more than 30 percent after obtaining regulatory approval from the United Kingdom Financial Conduct Authority (FCA).