Barry Silbert, CEO and founder of Digital Currency Group—a conglomerate of many blockchain-oriented services including Grayscale and Coindesk—has compared the ongoing Bitcoin (BTC) rally with the 2017 euphoria. Here's why institutional interest may be very far from being the key difference.

2017 run was unexplainable

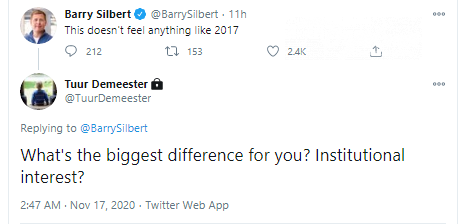

Silbert highlighted that his personal feelings do not resemble his feelings in 2017. Prominent investor and analyst Tuur Demeester, the author of the "Bitcoin Reformation" theory, asked him the main reason for this.

Silbert noted that, in 2017, nobody knew why crypto prices were rocketing. This phenomenon was totally inexplicable to the general public.

In 2020, the situation changed, and an upsurge of digital asset prices can be reasonably explained by the profound trends.

Meanwhile, no reporters have contacted Mr. Silbert over the past month, he claims. This fact is "interesting" to him since their ignorance is "great."

It is still very early

Silbert shared this take after the impressive announcement by his most popular project, Grayscale Investments firm. This entity provides investors with exposure to crypto markets, eliminating the need to purchase crypto tokens directly.

Today, Nov. 17, it was announced that Grayscale managed to allocate 500,000 Bitcoins (BTC) to its Bitcoin trust:

Grayscale Bitcoin Trust now holds more than 500,000 $BTC. Yes, you read that right.

Peter McCormack, influential crypto podcaster, commented in a semi-ironic manner that Silbert "bought all the Bitcoins" due to the aggressive buying policy of his Grayscale trusts.

At the same time, Dan Held—the growth leader at Kraken top-notch crypto exchange—supposed that it is too early for massive FOMO in crypto markets:

It really hasn't even gotten started yet.

Besides Bitcoin (BTC), Grayscale Investments offers its clients shares of Ethereum, Ethereum Classic, Litecoin, XRP, Bitcoin Cash, Horizen, Stellar Lumens and ZCash trusts, as well as of "Digital Large Cap," a unique integral investment product.