The second part of Coingecko's Q2, 2020 Quarterly Cryptocurrency Report addresses the turbulent segment of cryptocurrency exchange platforms. Traffic, trading volume and native asset performance are in the spotlight of the researchers.

Trading volume soars while traffic spikes

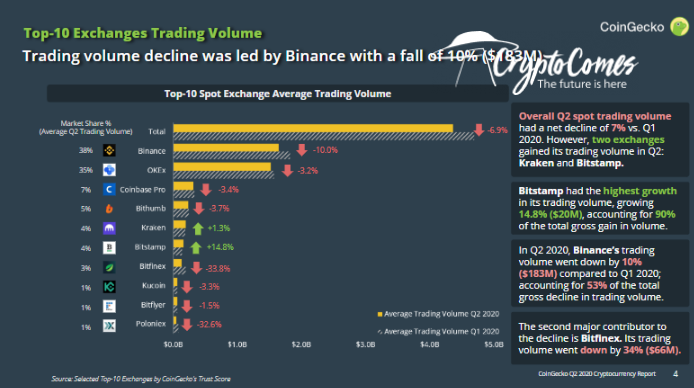

According to a report by Coingecko's Erina Azmi, the overall net traffic of top cryptocurrency exchange platforms dropped almost 7% in Q2, 2020. Bitfinex and Poloniex are among the leaders of the trading volume collapse with 34% and 33% declines respectfully.

However, two exchanges managed to gain trading volume in Q2, 2020. Bitstamp net trading volume saw a 14% increase while Kraken's surged 1.3%. The overall trading volume on the Top-10 Trusted Exchanges verified by Coingecko methods dropped 7%.

It is interesting that this collapse coincided with the insane rapid growth of the cryptocurrency segment's market capitalization. This number rose 44.5% and the Ethereum (ETH) market cap was among its leading catalysts.

Also, amidst significant trading volume decline, the web traffic of the exchange domains showcased double-digit gains. OKEx registered an enormous upsurge of 239% while Binance attracted 9% more visitors than in Q1, 2020.

Delayed breakthrough of decentralized exchanges

Since decentralized exchange services (DEXs) are among the most popular types of decentralized financial applications (DeFi), the euphoria around DeFi had no chance to go unnoticed for decentralized trading.

During Q2, 2020, the overall volume of trading on decentralized exchanges surged 56.1%. The Uniswap V1 protocol is the flagship service of this segment, with a 152.4% increase.

Finally, Coingecko analysts registered a continuation of the splendid performance of exchange tokens. The average return for HT, BNB, LEO, FTT and OKB exceeded 21%.