Bitcoin (BTC) impressive run over $13,000 had no chances of going unnoticed on the futures markets. Open interest (the net volume of unsettled contracts) is targeting local highs across all major exchanges.

Bitcoin (BTC) futures open interest jumps 25% over past days

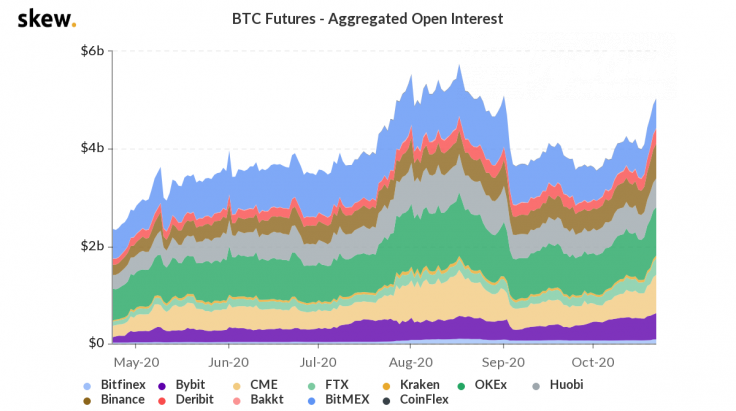

According to the data from Skew analytical dashboard, aggregated open interest in Bitcoin (BTC) futures is rocketing hand-in-hand with Bitcoin (BTC) price. Despite the fact it is still nowhere near the mid-August highs, the growth trend looks quite obvious.

Since Oct.16, 2020, aggregated open interest spiked from $4 bln to $5 bln. It should be noticed that a historical all-time high was registered on Aug.17. The total value of unsettled contracts surpassed $5.7 bln, which is 14% higer than today.

Also, this indicator witnessed a significant spike in February. On Feb.14, 2020, a month prior to the scariest correction of Bitcoin (BTC) price, the total aggregated open interest was as high as $5.4 bln.

Black Thursday in crypto erased almost 70% of this level: in late March the indicator in question sat near $1.8 bln level for multiple days.

Castling of giants

Last three days that excited global cryptocurrencies community with a marvellous Bitcoin (BTC) rally to new yearly highs did not leave the ranking of top futures markets players unaffected.

Chicago Mercantile Exchange operated by CME Group, Inc. has been gaining steam for seven days in a row. It has managed to surpass two of its dangerous competitors, Huobi Futures and BitMEX.

| Date/Platform | CME | BitMEX | Huobi |

| Oct.16, 2020 | 515 | 590 | 516 |

| Oct.22, 2020 | 790 | 601 | 591 |

Thus, CME witnessed a whopping 54% weekly increase in open interest. OKEx, which is being attacked by Chinese regulators, surprisingly refuses to give up and holds the first place with $992 mln in Bitcoin (BTC) Futures OI.