Yesterday's Uniswap (UNI) airdrop craze has resulted in a whopping increase in the trading volume registered on decentralized Ethereum-based platforms. According to Dune Analytics research team, this indicator has rocketed to the ten-digit zone.

Crucial milestone for DEXs and Ethereum

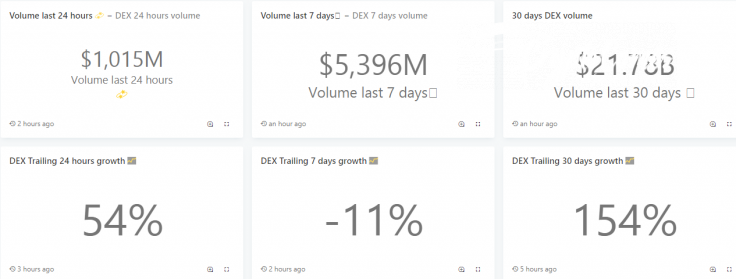

Dashboards developed by Dune analysts reveal a monstrous spike in DEX-based trading that was surrounded by Ethereum (ETH) network congestion yesterday. The entire DEX segment has processed more than $1,000,000,000 USD in the last 24 hours.

Exchanges from the top league, i.e., the five platforms with the largest daily trading volumes, are responsible for almost 98 percent of this huge amount.

The flagship beneficiaries of the ongoing DeFi euphoria, UniswapV2 (UNI), Curve (CRV) and Balancer (BAL), are at the top of DEX leaderboard. Veterans of decentralized crypto trading on Ethereum, 0x (ZRX) and Kyber Network (KNC), have found themselves in the fourth and fifth positions, respectfully.

One billion dollars in 24H trading volume do not represent the only impressive breakthrough of the decentralized trading segment noticed by Dune Analysts. According to them, DEXs added 154 percent in trading volume in the last few months.

Uniswap (UNI) airdrop is an unparalleled catalyst for DEX rise

A huge spike in trading activity on Ether-based DEXs can be mostly explained by a unique airdrop for all Uniswap DEX traders that was organized yesterday. Every trader registered on Uniswap before Sept. 1 has been airdropped 400 free UNI tokens. At press time, this portion costs almost $2,100, making it the most generous airdrop in crypto history.

The role of Uniswap in this spike is reflected in the number of traders that transacted in the last 24 hours on decentralized Ethereum-based exchanges. Dune Analysts show that Uniswap, with its 82,386 users, is surpassing its closest follower, Curve, by 4,157 percent. Moreover, it is responsible for 60 percent of all trading volume in the past 7 days.

This inspiring airdrop may help Uniswap to shrug off the aftermath of the "vampire attack" by the infamous SushiSwap (SUSHI) protocol. As covered by CryptoComes previously, SushiSwap drained 70 percent of Uniswap's liquidity by pledging more profitable "yield farming" strategies and periodic SUSHI token distribution.