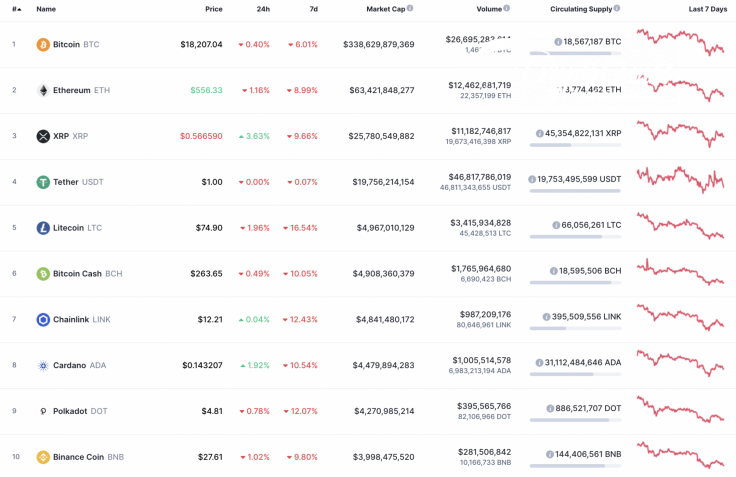

Most of the Top 10 coins remain under a bearish mood even though the correction might have finished for some assets. Mainly, XRP, Chainlink (LINK) and Cardano (ADA) are in the green zone.

The vital information on Litecoin (LTC), Binance Coin (BNB) and Chainlink (LINK).

|

Name |

Ticker |

Market Cap |

Price |

Volume (24h) |

Change (24h) |

|

Litecoin |

LTC |

$4,967,010,129 | $75.02 | $3,415,934,828 | -2.17% |

|

Binance Coin |

BNB |

$3,998,475,520 | $27.63 | $281,506,842 | -1.40% |

|

Chainlink |

LINK |

$4,841,480,172 | $12.17 | $987,209,176 | -0.61% |

LTC/USD

Litecoin (LTC) is the main loser from the list. The rate of the "digital silver" has gone down by 2.17% over the last day.

On the daily chart, Litecoin (LTC) failed to fix above the crucial resistance of $90. The buying volume is declining, which means that the decline has not finished yet. At the nearest support level, traders may consider the $64 mark. If sellers break, the long-term bullish trend might come to an end.

Litecoin is trading at $74.71 at press time.

BNB/USD

Binance Coin (BNB) is looking more positive than Litecoin (LTC). The rate of the native exchange token has decreased by 1.40% over the previous 24 hours.

On the daily time frame, Binance Coin (BNB) has bounced off the support at $27. A further drop is unlikely to occur as there is almost no liquidity below $25.

The selling trading volume is also going down, which means that bulls have quite a good chance of seizing the initiative and getting the rate of the altcoin to the range of $28.50-$29.50 shortly.

Binance Coin is trading at $27.64 at press time.

LINK/USD

Chainlink (LINK) is the top gainer today. Its rate has declined by only 0.61% since yesterday.

From the technical point of view, Chainlink (LINK) is trading similarly to Litecoin (LTC), as the ongoing correction might not have finished yet. As the more likely price action, the rate of the altcoin may face one more wave of a drop to the liquidity level at $11.30 before the growth continues.

Chainlink is trading at $12.06 at press time.