The cryptocurrency market is trying to recover after yesterday's decline. However, with regards to the DeFi tokens, most of them are in the red except for a few that remain under bullish sentiments.

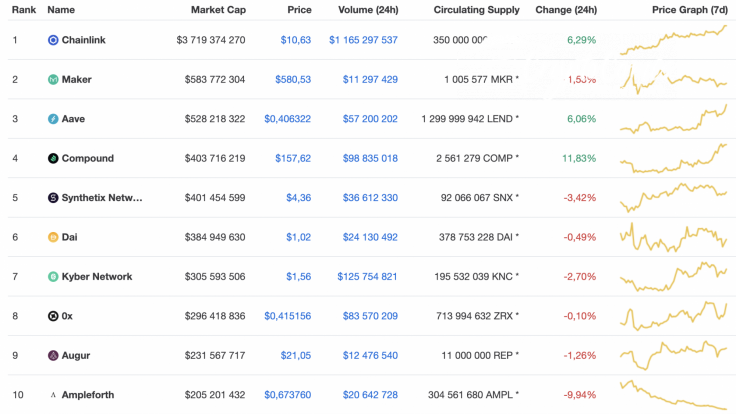

Below are the key statistics for Chainlink (LINK), Aave (LEND), Maker (MKR), and Compound (COMP):

|

Name |

Ticker |

Market Cap |

Price |

Volume (24H) |

Change (24H) |

|

Chainlink |

LINK |

$3,719,374,270 | $10.63 | $1,165,297,537 | 6.29% |

|

Aave |

LEND |

$528,218,322 | $0.406322 | $57,200,202 | 6.06% |

|

Maker |

MKR |

$583,772,304 | $580.53 | $11,297,429 | -1.53% |

|

Compound |

COMP |

$403,716,219 | $157.62 | $98,835,018 | 11.83% |

LINK/USD

Chainlink (LINK) is one of the top 10 DeFi tokens that has not yet faced a correction. Moreover, the rate of the coin has increased by 6.29% since yesterday, while last week constitutes a price change of 36.90%.

Looking at the daily time frame, Chainlink (LINK) continues to rise after successfully retesting the $9 zone. However, the ongoing growth is accompanied by a decreasing trade volume, which may be a reason for a possible correction. Anyways, there is a low probability of continuing to rise as LINK's liquidity is also located at their lowest levels. In this particular case, the more likely scenario is a consolidation within the yellow range between $9.20 and $10 through the end of the month.

At press time, Chainlink was trading at $10.62.

LEND/USD

Aave (LEND) is also located in the green; however, it has not increased as much as LINK. The DeFi token has gained 28% from the previous week.

The technical picture of Aave (LEND) is similar to that of Chainlink (LINK). The token has already on the verge of the overbought sector according to the Relative Strength Index (RSI). Thus, the trading volume is going down, which confirms the bearish sentiments.

Even though buyers continues to dominate the market, LEND may face a slight drop to its closest level at $0.3845 in order to gain strength for the upcoming price growth.

At press time, LEND was trading at $0.4124.

COMP/USD

Compound (COMP) is the biggest gainer from our list. The price of the token has skyrocketed by almost 12% from the previous day.

Even though Compound (COMP) has increased significantly, the growth potential remains as the token has gained enough strength for a continued rise. Thus, the lines of the Moving Average Convergence/Divergence (MACD) has entered bullish territory. Furthermore, the buying volume is high considering a continued rise to the closest resistance at $163. Once bulls reach their level, traders need to pay close attention as to whether the token closes above the aforementioned mark or makes a false breakout.

At press time, Compound was trading at $159.

MKR/USD

Maker (MKR) is the only coin from our list that is located under the thumb of the bears. The token has lost 1.53% of its price share since yesterday.

However, looking at the 4H chart, the altcoin is about to break out of the triangle pattern which will confirm pressure from buyers. If Maker (MKR) follows that scenario, then a rise may continue until the token reaches the $613 mark. However, to attain that level, the trading volume needs to increase as another scenario by the bears may seize on the initiative and push the coin below $570.

At press time, Maker was trading at $581.63.