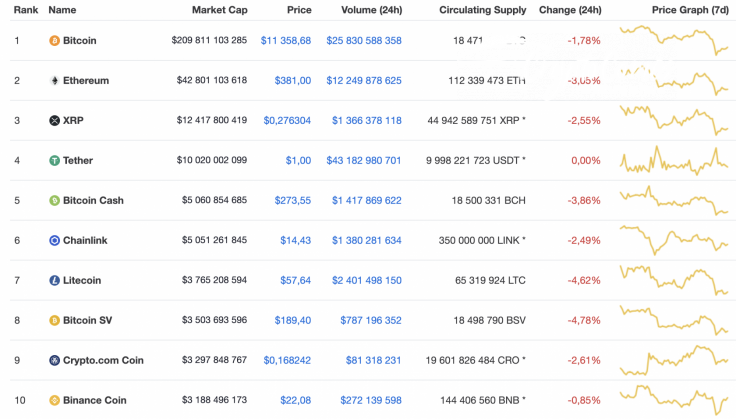

Bears have totally seized the initiative as all top 10 coins are in the red. The main loser is Bitcoin SV (BSV), whose rate has declined by almost 5% since yesterday.

The key data for Bitcoin (BTC), Stellar (XLM), Cardano (ADA), Chainlink (LINK) and TRON (TRX):

|

Name |

Ticker |

Market Cap |

Price |

Volume (24h) |

Change (24h) |

|

Bitcoin |

BTC |

$209,811,103,285 | $11,358.68 | $25,830,588,358 | -1.78% |

|

Stellar |

XLM |

$2,015,063,825 | $0.097829 | $266,359,351 | -3.27% |

|

Cardano |

ADA |

$2,927,168,766 | $0.112900 | $452,081,830 | -6.79% |

|

Chainlink |

LINK |

$5,051,261,845 | $14.43 | $1,380,281,634 | -2.49% |

|

TRON |

TRX |

$1,661,784,161 | $0.023190 | $680,217,935 | -4.64% |

BTC/USD

Yesterday, in the first half of the day, bearish pressure intensified. They were able to break through the 50% Fibo level ($11,394) and at the end of the day pierced the support of $11,200. The daily low was fixed at $11,112.

In the evening, buyers tried to regain position with large volumes and restored the pair to the 50% Fibonacci level. In the morning, the volume of purchases decreased significantly, so the price of Bitcoin (BTC) cannot now recover above the 50% Fibo resistance ($11,394).

If buyers resume the onslaught, then the decline in the price of BTC may continue to the psychological level of $11,000. It is possible that the trend line will be able to stop the fall of the pair today, and the price will briefly consolidate near the lower border of the ascending channel.

Bitcoin is trading at $11,309 at press time.

XLM/USD

Stellar (XLM) is also located in the "short" zone. The rate of the altcoin has decreased by 3.27% while the price change over the previous week has accounted for -6.95%.

On the daily chart, bears control the situation. However, the selling volume has reached the lowest level, which means that a short-term rise is possible before the drop continues. If such a scenario comes true, traders may expect a false breakout of the resistance zone at $0.1031 followed by a price decrease to $0.08826.

Stellar is trading at $0.097 at press time.

ADA/USD

Cardano (ADA) is the biggest loser from today's list. The rate of the crypto has lost almost 7% of its share over the last 24 hours.

From the technical point of view, Cardano (ADA) made a far retest of the level of $0.1050 reached at the beginning of July. Bears might find it difficult to break above. What's more, the selling volume is also low. All in all, bulls may bounce off ADA to the nearest resistance at $0.12 followed by a further decline.

Cardano is trading at $0.1119 at press time.

LINK/USD

Chainlink (LINK) has lost less than others on our list. The price of the coin has declined by 2.49% since yesterday.

On the daily chart, Chainlink (LINK) has been declining since mid-August, and no signals of a potential reversal have appeared yet. The lines of the MACD indicator are going down, confirming a bearish scenario. The potential short-term reversal is possible when the altcoin reaches the support at $12.12.

Chainlink is trading at $14.18 at press time.

TRX/USD

TRON (TRX) is trading similarly to Chainlink (LINK), however, the decline is much more profound. The altcoin has dropped by 4.64% over the last day.

Even though the rate of TRON (TRX) has significantly declined recently, the coin has not reached a support zone where a potential bounce off may occur. The trading volume is still at its lowest levels, along with liquidity. In this regard, there is a high possibility of a continued decline to $0.02182 by the end of the month.

TRON is trading at $0.023 at press time.