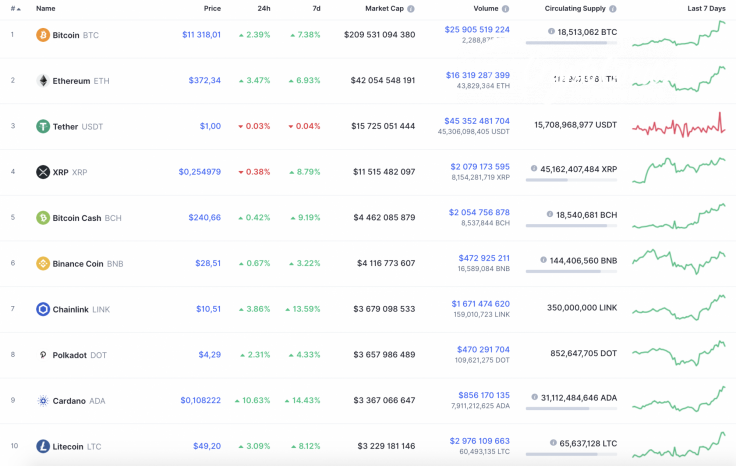

Saturday has started with a continued bullish mood on the cryptocurrency market. XRP is the only coin from the Top 10 list that is located in the bearish zone. Its rate has declined by 0.38% since yesterday.

The important statistics on Aave (LEND), Maker (MKR) and yearn.finance (YFI).

|

Name |

Ticker |

Market Cap |

Price |

Volume (24h) |

Change (24h) |

|

Aave |

LEND |

$678,597,337 | $0.521998 | $90,009,541 | 7.26% |

|

Maker |

MKR |

$565,892,709 | $562.83 | $39,815,273 | 4.99% |

|

yearn.finance |

YFI |

$512,674,962 | $17,107.59 | $1,969,918,209 | -9.57% |

LEND/USD

Aave (LEND) is the biggest gainer from our list today. The price of the DeFi token has risen by 7.26% since yesterday, while the price change over the last week has made up -5.14%.

On the daily chart, Aave (LEND) is facing a correction after a false breakout of the $0.90 mark. Even though the DeFi token has bounced off the support at $0.39, it lacks the power to set new peaks. In this case, the ongoing rise may finish at the resistance of $0.60, followed by a continued drop.

Aave is trading at $0.5190 at press time.

MKR/USD

Maker (MKR) is another gainer from our list. The price of the altcoin has gone up by almost 5% over the previous 24 hours.

Maker (MKR) has reached the "mirror" level at $597 that is unlikely to be broken from the first time. Furthermore, bulls have low chances of moving further due to the declining trading volume and no liquidity support.

To sum up, traders may expect a decline to the support level at $431 soon.

Maker is trading at $583.27 at press time.

YFI/USD

Yearn.finance (YFI) is an to the rule, as it is the only coin from our list that is located in the bearish zone. The drop has constituted 9.57% over the last day.

Although the price of the coin has decreased by almost 10% since yesterday, the decline might has not ended yet. The liquidity level is high, however, the volume is not great enough to push the rate of YFI higher. Applying Bollinger Bands to the chart, the DeFi token may rise to the basic line of the indicator, followed by a drop to the support of $11,000 by the end of the month.

Yearn.finance is trading at $17,115 at press time.