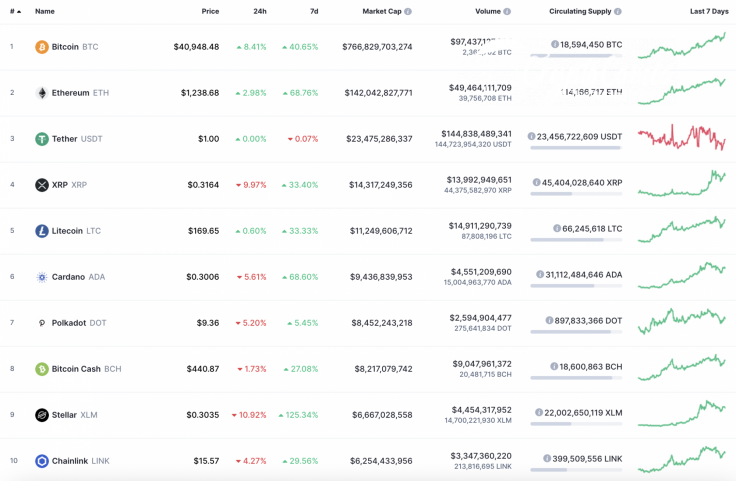

At the end of the week, traders might have started fixing their long positions as come coins have already faced the correction phase. Stellar (XLM) is the main loser, falling by more than 10%.

Meanwhile, the cryptocurrency market capitalization has surpassed the $1 trillion mark.

The relevant data for Ethereum is looking the following way:

-

Name: Ethereum

-

Ticker: ETH

-

Market Cap: $141,184,999,970

-

Price: $1,246.89

-

Volume (24h): $49,455,690,009

-

Change (24h): 2.35%

The data is relevant at press time.

ETH/USD: Can Ethereum set the all-time high this week?

Yesterday morning, the Ethereum (ETH) price held above 1150.00 USD and, during the day, buyers were able to come close to the level of $1,300, setting a new January high at $1,291.

In the high zone, sellers formed bearish momentum that knocked down the growing dynamics of the pair and pushed prices back to the hourly EMA55. This evening, the bears were able to push through the average price level and set a local minimum at $1,065.

In the morning, the pair is trying to recover, but the resistance of the hourly EMA55 does not allow buyers to gain a foothold above the average price level on small volumes. If, during the day, trading volumes remain at a low level, then the pair will fight in a wide sideways range. The range will narrow significantly by the end of the week.

On the bigger time frame, one may expect a correction to the mirror level at $1,170. Such a move may occur as the liquidity at current levels is not enough to keep the rise. In addition, the trading volume is going down, implying a short-term drop.

On the weekly chart, growth may continue to the far retest level at $1,380 at which a more profound correction may begin. However, it does not mean that bears will seize the initiative in the long-term scenario.

Ethereum is trading at $1,248 at press time.