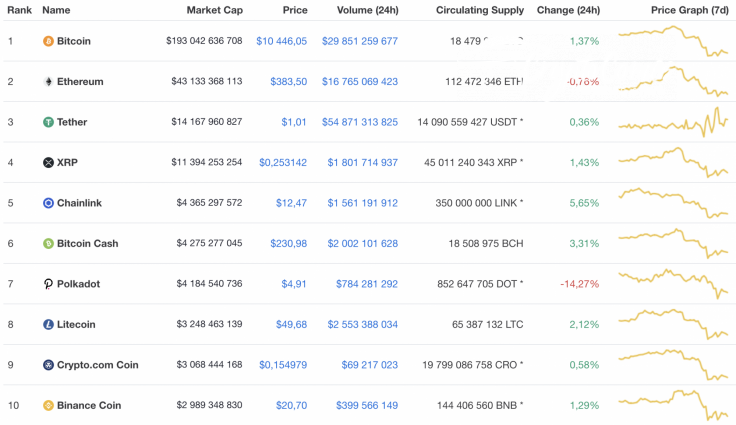

The weekend started on a relatively positive note for the market; however, some of the coins remain in the red. This mainly applies to Polkadot (DOT), which remains the main loser and has gone down 14.27%.

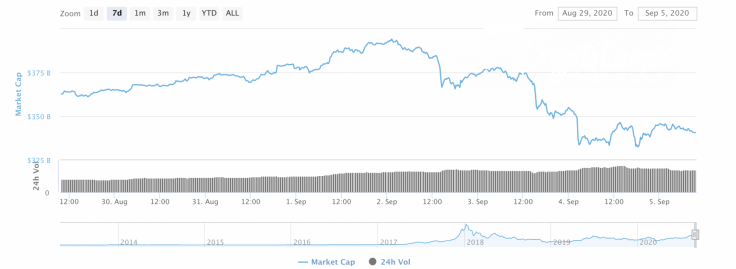

The bearish sentiments of the market have negatively affected the cryptocurrency's market capitalization, which lost $20 billion since last week and accounts for $342 billion.

The relevant data of EOS is looking the following way.

-

Name: EOS

-

Ticker: EOS

-

Market Cap: $2,879,938,588

-

Price: $3.08

-

Volume (24H): $5,782,672,218

-

Change (24H): 14.44%

The data was relevant at press time.

EOS/USD: Could EOS be the Example for the Market to Follow?

EOS is the biggest gainer from the top 20 coins. The rate for the altcoin has skyrocketed up by almost 15% since yesterday, while the price change from last week has gone down 1.72%.

Looking at the hourly chart, EOS continues to rise; however, the following rise is considered a rise after the sharp decline, but not the start of a new bull run. The value from the Relative Strength Index (RSI) has not yet reached the overbought zone, which means that the bulls still have the potential. In this particular regard, the resistance zone would be around the $3.25 mark.

Looking at the daily time frame, EOS might have made a reversal after a false breakout at the $2.60 mark. However, the cryptocurrency still lacks energy for a V-shaped recovery, which means that a retest may occur. The low trading volume supports such a scenario, which means that a short-term drop to the support level at $2.86 might happen soon.

Looking at the weekly chart, a bullish scenario remains relevant. Even though there are a few chances of setting new local peaks, a retest to $3.69 may occur.

The high liquidity level around the aforementioned zone supports the following price action. If the bulls can maintain the rate of EOS above $3, then the aforementioned resistance may be attained through the end of the month.

At press time, EOS was trading at $3.04.