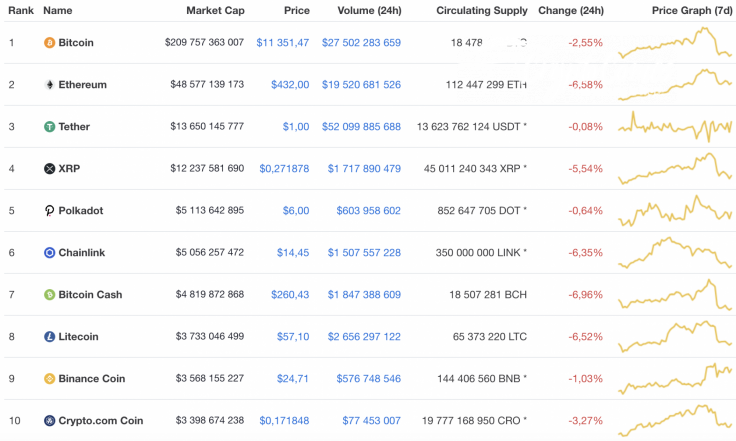

The bearish mood has just become more powerful after yesterday's dump in the market. All coins are located in the red zone while the top loser is Bitcoin Cash (BCH)—whose rate has declined by almost 7%.

The key information for Chainlink (LINK), Cardano (ADA) and EOS today:

|

Name |

Ticker |

Market Cap |

Price |

Volume (24h) |

Change (24h) |

|

Chainlink |

LINK |

$5,056,257,472 | $14.45 | $1,507,557,228 | -6.35% |

|

Cardano |

ADA |

$2,955,123,271 | $0.113978 | $401,185,163 | -4.52% |

|

EOS |

EOS |

$2,837,824,731 | $3.03 | $3,326,035,688 | -8.56% |

LINK/USD

Chainlink (LINK) is trading within the correction cycle on the daily chart. There has been a decline of 6.35% over the past day while the drop over the last week has been 9.69%.

Chainlink (LINK) is still bearish as there is no buyer pressure based on the declining trading volume and low liquidity level.

However, the ongoing price drop is considered as part of the correction phase but not a start of a new bearish wave. In this case, the closest support at which bulls might resist is the $12 mark.

LINK is trading at $13.48 at press time.

ADA/USD

Cardano (ADA) is not an exception to the rule as it is also located in the red zone. However, the decline has not been so profound as in the case of Chainlink (LINK). The altcoin has lost 4.52% over the last 24 hours.

Even though Cardano (ADA) is bearish now, it has reached the local support level and is about to bounce off. The RSI indicator, located almost in the oversold area, confirms such a statement. Thus, the low selling volume is an obstacle to a continued price drop. This is why traders might expect a slight rise to $0.1155 soon.

Cardano is trading at $0.1063 at press time.

EOS/USD

The EOS cryptocurrency continues to test resistance. It should also be noted that the "Head and Shoulders" reversal pattern is forming here. In case of a breakdown of the lower border of the ascending channel with the price fixing below the level of $2.90, one should expect it to fall within the framework of the reversal pattern to the level of $2.20 and below.

It is important for buyers to achieve an update of the local maximum level and consolidation of quotes above the $3.95 level. In this case, it will be possible to talk about the cancellation of the reversal pattern and the stable development of upward momentum to the level of $4.65 and above. This scenario is also supported by a rebound from the support line on the RSI indicator.

EOS is trading at $2.89 at press time.