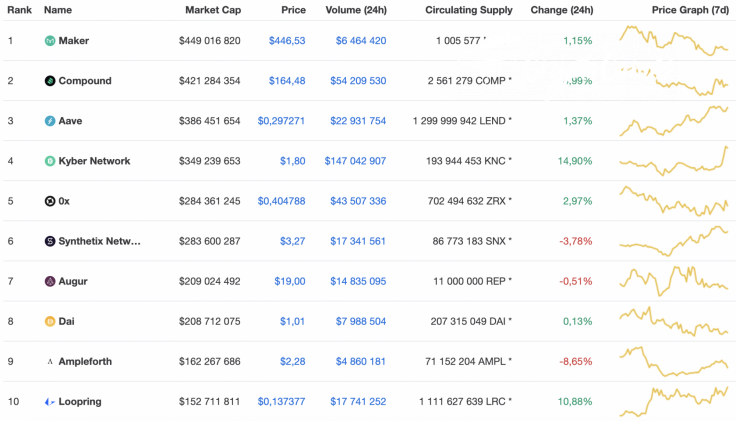

To a certain extent, the DeFi tokens are more volatile than the top cryptocurrencies. Most of them are in the green; however, there are some exceptions to the rule. This mainly applies to the Synthetix Network token (SNX) and Ampleforth (AMPL), which have declined by 3.78% and 8.65% respectively.

Below is the main data for Aave (LEND), Kyber Network (KNC), and Synthetix Network Token (SNX) and how they're looking today:

|

Name |

Ticker |

Market Cap |

Price |

Volume (24H) |

Change (24H) |

|

Aave |

LEND |

$385,486,119 |

$0.296528 |

$22,612,589 |

1.24% |

|

Kyber Network |

KNC |

$348,169,571 |

$1.80 |

$146,844,927 |

14.53% |

|

Synthetix Network Token |

SNX |

$283,373,446 |

$3.27 |

$17,247,388 |

-3.73% |

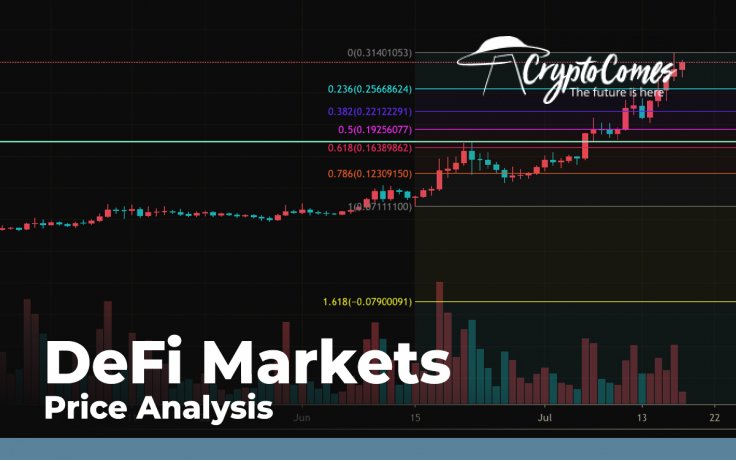

LEND/USD

Aave (LEND) is one of the DeFi tokens that has grown the most since last week. Even though yesterday's price change has only gone up by +0.36%, the altcoin has skyrocketed by about 58% over the last 7 days.

Looking at the daily chart, Aave (LEND) is already overbought. This is based on the Relative Strength Index (RSI). The altcoin's trading volume is also on a slight declining. In order to continue moving upwards, the bulls need to accumulate power. This is why a correction is the most likely scenario within the next few days. In this regard, traders may expect a price drop to $0.25 next week.

At press time, LEND is trading at $0.2920.

KNC/USD

Kyber Network (KNC) has also reached it local peak; however, the token could not fix above the $2 mark. KNC is the top gainer from our list, skyrocketing up by 14.53% since yesterday.

KNC has formed a bearish divergence on the RSI according to the daily chart. Apart from that, the liquidity is low, which means that there is a low probability for KNC to continue rising at its current levels. All in all, the bears may push back against the token to the $1.53 support level within the next few days.

At press time, KNC is trading at $1.81.

SNX/USD

SNX is the only loser from our list as its rate has gone down by 1.80% in the last 24 hours. However, the price over the last 3 days has constituted a gain of +38%.

Looking at the 4H time frame, Synthetix Network Token (SNX) has already started a correction after failing to fix around the $3.50 level. The drop may continue as there is no interest from buyers due to the decreasing trading volume. The first support level where the bulls may resist is at $3.18. In case the bears break through, the next stop will be at the $2.98 mark.

At press time, SNX is trading at $3.28.