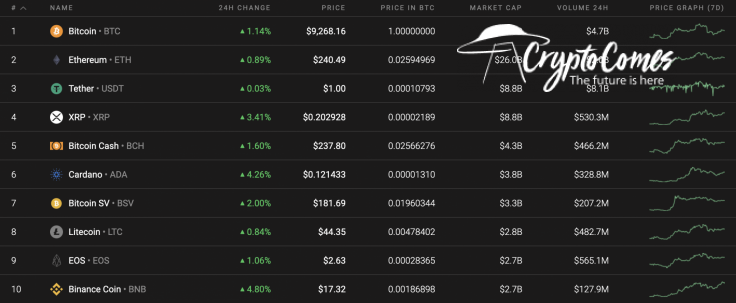

With the start of the weekend, the cryptocurrency market has switched to greed. All of the Top 10 coins are in the under the dominance of the bulls, with the top gainer being Binance Coin (BNB), whose rate has increased by 4.80% since yesterday.

Below is the main data for Compound (COMP), Maker (MKR), and 0x (ZRX):

|

Name |

Ticker |

Market Cap |

Price |

Volume (24H) |

Change (24H) |

|

Compound |

COMP |

$457,802,137 |

$178.74 |

$61,714,787 |

1.61% |

|

Maker |

MKR |

$462,933,451 |

$460.37 |

$5,670,485 |

1.51% |

|

0x |

ZRX |

$301,052,667 |

$0.428548 |

$53,159,269 |

6.16% |

COMP/USD

One of the most popular DeFi tokens, Compound (COMP), might have found a local bottom at $175. The rate of the token has increased by almost 2% since yesterday.

Looking at the hourly chart, Compound (COMP) is trading within a narrow rising channel accompanied by a rising volume. This means that there are a few chances for a false breakout.

What is more, there is a high level of liquidity above $180, which is also a signal of growth. As the more likely price option, buyers may push the coin to the $180-$185 area by next week.

At press time, Compound was trading at $179.19.

MKR/USD

Maker (MKR) is looking less positive as compared to Compound (COMP) even though the rate of the token has gone up by 1.51% from the previous 24 hours.

According to the daily chart, Maker (MKR) is located in the range after a drop to $415. Currently, the token is accumulating strength for a move up or down as volatility drops. Besides, the trading volume continues to decline. In this particular case, the sideways trend may continue between the $506 support zone and the $413 resistance mark.

At press time, Maker was trading at $462.44.

ZRX/USD

ZRX is the biggest winner from our list. The rate for the DeFi token has skyrocketed by 6.16% since yesterday, while the weekly change was up +6.72%.

Even though ZRX has recently shown signs of impressive growth, there is a high probability of seeing a correction soon. The trading volume has dropped, which might be a reason for a decline. If that happens, the nearest support mark is at $0.39, and this might be achieved next week. If the bulls maintain the aforementioned level, then the rise may continue.

At press time, ZRX was trading at $0.4330.