The weekend has begun with a relatively neutral mood on the cryptocurrency market as neither buyers nor sellers are dominating at the moment.

The important data for Bitcoin (BTC), Chainlink (LINK), Polkadot (DOT), Cardano (ADA) and Tron (TRX) today:

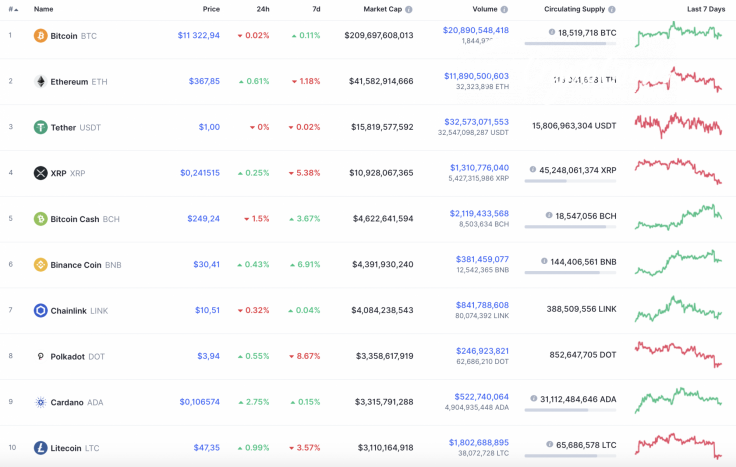

|

Name |

Ticker |

Market Cap |

Price |

Volume (24h) |

Change (24h) |

|

Bitcoin |

BTC |

$209,697,608,013 | $11,322.94 | $20,890,548,418 | -0.02% |

|

Chainlink |

LINK |

$4,084,238,543 | $10.51 | $841,788,608 | -0.32% |

|

Polkadot |

DOT |

$3,358,617,919 | $3.94 | $246,923,821 | 0.55% |

|

Cardano |

ADA |

$3,315,791,288 | $0.106574 | $522,740,064 | 2.75% |

|

Tron |

TRX |

$1,859,095,835 | $0.025943 | $852,035,841 | 1.15% |

BTC/USD

The rate of Bitcoin (BTC) has remained at the same place as last week. The price has changed by 0.11%.

On the 4H chart, Bitcoin (BTC) could not fix above $11,500, which means that bulls lack the power to keep the growth going. The trading volume is going down, which makes the position of bears stronger.

In the short term, a price drop is possible to the area of $10,100, where most of the liquidity is focused.

Bitcoin is trading at $11,347 at press time.

LINK/USD

Chainlink (LINK) is the main looser from our list, as the rate of the altcoin has dropped by 0.32% over the previous 24 hours.

From the technical point of view, the ongoing decline has not finished yet because volume, as well as liquidity, is not enough for a reversal. Thus, one may notice a bearish divergence on the Relative Strength Index indicator. All in all, traders may see Chainlink (LINK) trading at around $9.22 soon.

Chainlink is trading at $10.65 at press time.

DOT/USD

Polkadot (DOT) has gained a few points since yesterday; however, the rate of the coin has dropped by almost 9% over the last 7 days.

On the daily time frame, Polkadot (DOT) is not ready to switch to a bullish wave and keep the growth. Most likely, the decrease may continue to the support zone of $3.57, followed by a price blast to $5.10. Such a scenario is relevant until the end of the current month.

Polkadot is trading at $3.94 at press time.

ADA/USD

Cardano (ADA) is the top gainer today as the price change since yesterday has constituted 2.75%.

Cardano (ADA) has bounced off the support of the rising channel, having confirmed the growth potential. A further rise is more likely than a drop as the liquidity is concentrated above $0.12. In this case, the endpoint of the current growth may be the support at $0.1237.

Cardano is trading at $0.1066 at press time.

TRX/USD

Tron (TRX) has also located in the bullish zone over the last day. However, it has not shown such a big price rise as Cardano (ADA).

On the daily chart, Tron (TRX) keeps trading sideways, accumulating power for a price blast. At the moment, neither bulls nor bears have seized the initiative. To sum up, the ongoing trend is about to continue and the altcoin might locate in the range of $0.027-$0.028 shortly.

TRX is trading at $0.025 at press time.