Ripple has won back the critical level at $0.30. Our price analysis explains whether it has efforts to fix above $0.31 or not

Cover image via www.freepik.com

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of CryptoComes. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

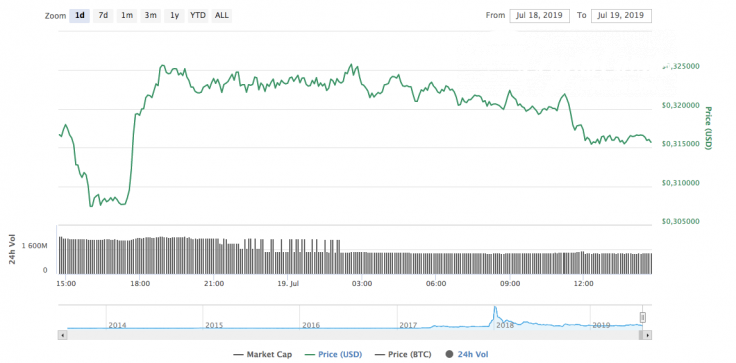

The market reversal which has happened a few days ago has not influenced the price of XRP, whose rate has increased by only 0.15% over the last 24 hours.

The trading volume index has lost around $1 Bln, suggesting that traders prefer other coins to XRP.

XRP chart by CoinMarketCap

XRP chart by CoinMarketCap

Now, let’s get to the chart for a better understanding of the short-term analysis.

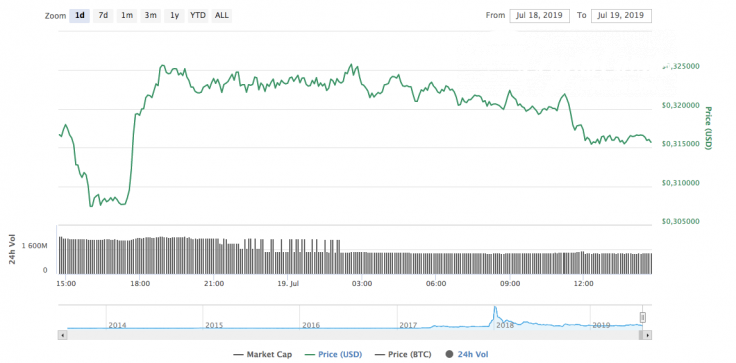

XRP/USD chart by TradingView

XRP/USD chart by TradingView

Yesterday, July 18, sellers managed to drive the price into the yellow side corridor and set a local minimum at the point of $0.305 during the confrontation at the upper limit of the range $0.310.

However, buyers could not seize the initiative and the bullish impulse pushed the pair above the level of $0.320.

At the moment of the writing, the trading volume is at an average level, and XRP is trying to consolidate in the area of support at $0.320. If today the hourly EMA55 is not able to support the pair, Ripple will return to the yellow side corridor.

The price of XRP is trading at $0.3162 at the time of writing.

In this Telegram channel you’ll find fresh news, interviews, infographics, forecasts & other helpful stuff.

Join CryptoComes's channel.

Denys Serhiichuk

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis. Mainly, he has started his blog on TradingView where publishes all relevant information and makes predictions about top coins.

Thus, his experience is backed up by working in top blockchain related companies such as W12, Platinum Listing & ICO Advisory, ATB Coin, and others, can be contacted at [email protected]